A principal pillar of the cryptocurrency market, Bitcoin has generated a lot of interest and curiosity. Since its creation in 2009, this digital currency has not only revolutionized the global financial landscape but has also raised fundamental questions about the future of fiat currencies. Who is behind this invention? What exactly is Bitcoin used for? Let’s dive into the world of the first cryptocurrency to better understand its essence and impact.

What is Bitcoin?

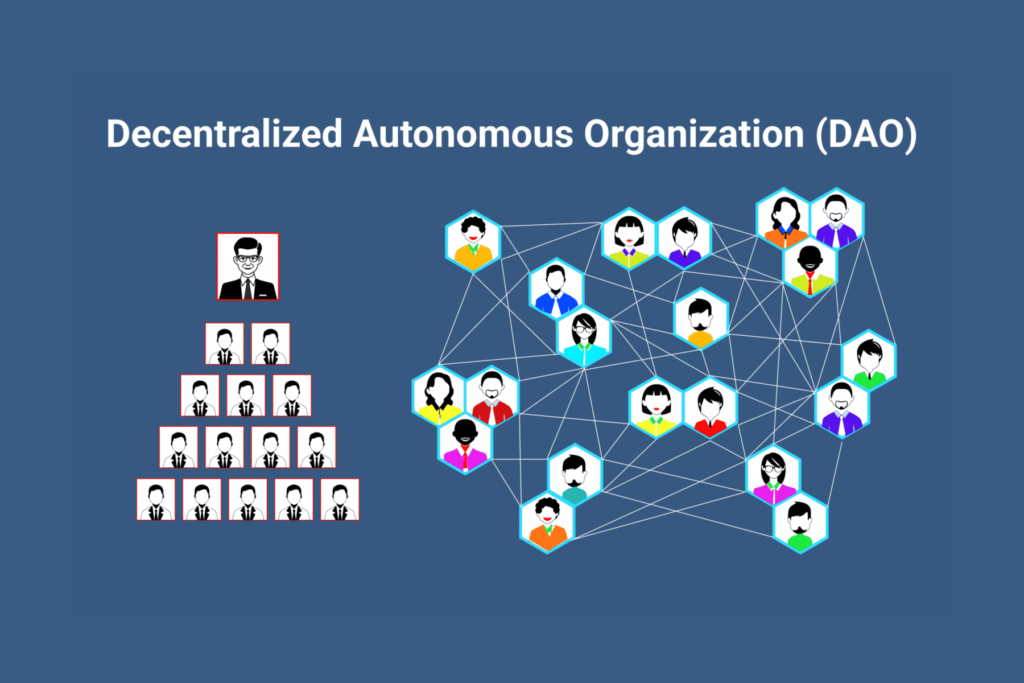

Bitcoin is a decentralized digital currency that allows direct transactions between users without going through a central entity like a bank. Its distinctiveness lies in blockchain technology: a public and distributed ledger that records all transactions securely. Each transaction is validated by “miners,” who use powerful computers to solve complex mathematical problems and are rewarded in bitcoins for their work.

History of Bitcoin

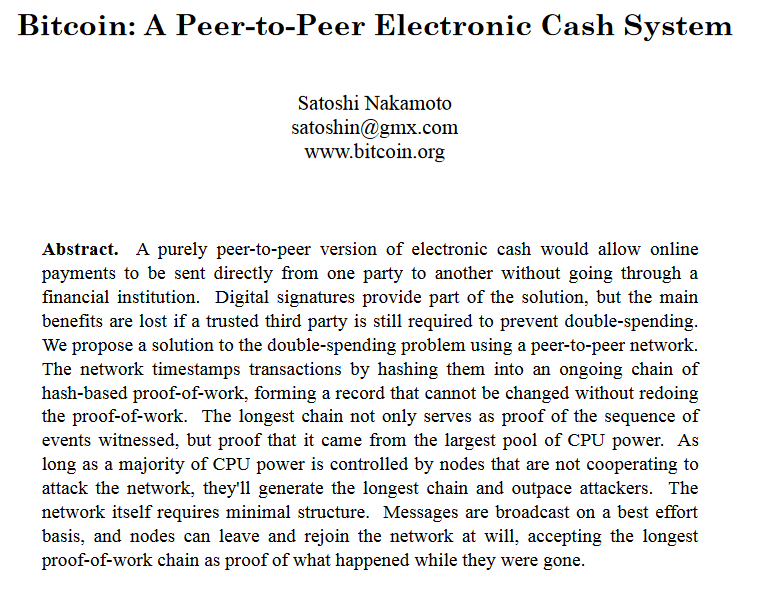

Bitcoin was born from a paper published in 2008 by Satoshi Nakamoto. Titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” the paper described an innovative method of using a distributed database, the blockchain, to create a decentralized electronic payment system free from financial authority surveillance. In January 2009, Nakamoto mined the first block of the chain, known as the Genesis block, marking the official birth of Bitcoin.

Bitcoin’s early years were marked by relative obscurity, with the cryptocurrency largely confined to cypherpunk and technophile circles. The first notable transaction using Bitcoin took place in May 2010, when Laszlo Hanyecz bought two pizzas for 10,000 bitcoins, a transaction that is worth hundreds of millions of dollars today. This event is still celebrated in the Bitcoin community as “Bitcoin Pizza Day.”

Over the years, Bitcoin has experienced several boom and bust cycles, often driven by changes in public perception, government regulations, and its adoption by merchants and institutional investors. Key moments include its peak of nearly $20,000 in December 2017, followed by a significant fall, and then a rise to new historic highs in 2021.

Who is Satoshi Nakamoto?

The question of who created Bitcoin is fascinating because, a decade after the invention of this technology, despite extensive research by journalists and members of the crypto-community, its creator remains anonymous.

Satoshi Nakamoto is the pseudonym of the person, or group of people, who designed and created Bitcoin as well as its first client software: Bitcoin-Qt (now Bitcoin Core). Nakamoto is also the founder of bitcoin.org and the bitcointalk forum.

Bitcoin Whitepaper link: https://bitcoin.org/bitcoin.pdf

How many Bitcoins are in circulation worldwide?

You might be wondering how many Bitcoins are currently circulating worldwide. As of the end of April 2024, about 19.6 million Bitcoins have been mined, according to CoinGecko data. This means that more than 93% of the planned Bitcoins have already been mined, leaving fewer than 1.4 million Bitcoins still to be mined.

For comparison, about 190,000 tonnes of gold have been mined to date, and it is estimated that 50,000 tonnes remain to be mined. This comparison highlights one of the fundamental problems with gold: the uncertainty about how much remains.

In contrast, the quantity of Bitcoins in circulation is regulated by a global network of computer servers, known as miners. According to the algorithm that governs Bitcoin, the total number of Bitcoins will precisely reach 21 million units in 2140, and not one more.

What is Bitcoin halving?

Bitcoin halving refers to the event by which the miners’ reward is halved approximately every 4 years, or every 210,000 blocks mined. The last one took place on April 19, 2024, and three halvings had previously occurred: on May 11, 2020; July 9, 2016; and November 28, 2012. The April 19, 2024 halving reduced the miners’ reward from 6.25 to 3.125 bitcoins. The next halving will reduce the mining reward to 16.625 BTC. With the halving, the total computing power needed to record a new block on the blockchain will also increase. And with it, the duration with which bitcoins are mined also increases.

The halving, due to the resulting scarcity of Bitcoin, tends to drive up the cryptocurrency’s price. The next halving will occur in April 2028. Prices are expected to climb until then and continue to rise for about a year after the halving until reaching a new high for BTC.

The Future of Bitcoin

Today, used by hundreds of millions of people around the world, Bitcoin has become a symbol of individual freedoms. Its protocol has evolved since its creation to become a financial solution adopted by the world’s largest companies, such as BlackRock, PayPal, and members of the GAFAM group. Some countries, like El Salvador, have even adopted Bitcoin as an official currency, demonstrating its global impact and growing recognition as a viable alternative to traditional currencies.

The future of Bitcoin is uncertain and fascinating. While some experts predict that it will become a revolutionary global currency, others warn of a potential speculative bubble. What is clear, however, is that Bitcoin has already changed the way we think about money and will likely continue to influence the financial sector in the coming years.

Conclusion

Bitcoin is more than just a cryptocurrency; it has become a cultural and economic phenomenon that continues to challenge traditional financial structures. As the world moves towards increased digitalization, Bitcoin’s role will be crucial in shaping the future of financial transactions and the very notion of currency. Its history is a testament to technological innovation and humanity’s unceasing quest for financial autonomy.