Exchange Traded Funds (ETFs), also known as “trackers” or exchange-traded funds, are financial instruments that allow you to buy a share of a basket composed of various securities (stocks, bonds, commodities, cryptocurrencies, etc.) rather than a single asset. ETFs track indices like the S&P 500, CAC40, as well as more specific and complex indices.

What is an ETF?

An ETF is an index fund that seeks to replicate as closely as possible the performance of a stock market index, both upwards and downwards. The Securities and Exchange Commission (SEC) defines them as “investment funds issued by management companies and approved.”

There are also ETFs that track the performance of various cryptocurrencies, such as Bitcoin. For example, a Bitcoin ETF does not represent direct ownership of Bitcoin but rather a financial product that replicates the performance of Bitcoin.

Advantages of ETFs

The idea behind ETFs is based on two main advantages:

- Diversification and Reduction of Microeconomic Risks: A well-constructed basket of assets significantly reduces risks associated with a single company. For example, if the CEO of a major company is involved in a scandal, the value of its shares could plummet, but the impact on an ETF composed of numerous stocks would be minimal.

- Lower Management Fees: ETFs do not benefit from active management. They simply track a stock market index, which significantly reduces administrative fees compared to active portfolio management. However, this also means that ETFs are subject to market volatility without human intervention to protect the capital.

Different Types of ETFs

There are several types of ETFs, each employing a different strategy to replicate an index:

- Physically Replicated ETFs: This ETF holds all the stocks of the index it tracks. For example, an ETF on the S&P 500 would directly invest in each of the companies in the S&P 500. This approach can result in high costs (transaction fees, taxes).

- Synthetically Replicated ETFs: This ETF uses derivative instruments, such as futures contracts, to track the performance of the index without directly holding the stocks. For example, an ETF can open a futures contract on the S&P 500 to simplify the management and closing of positions.

- Sampled ETFs: This ETF holds a representative sample of the index’s stocks. For instance, it might invest in twenty companies of the S&P 500 to represent the entire index.

Consequences of Choosing an ETF

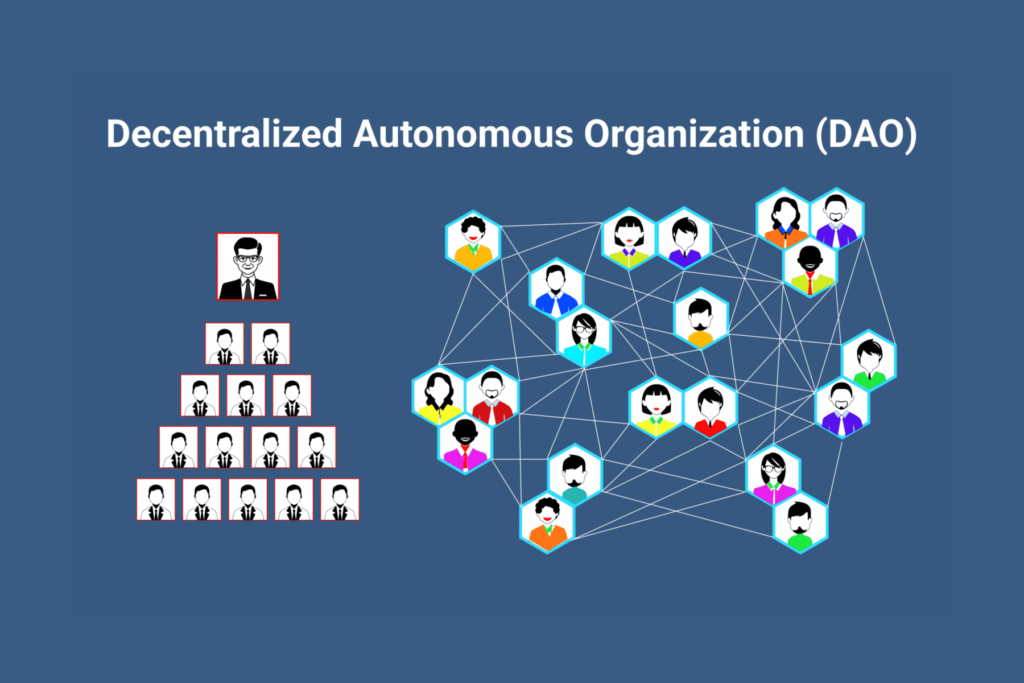

Investing via an ETF can have implications, particularly in terms of governance. The largest ETF investment funds, like Vanguard and BlackRock, hold shares in almost all major global companies. By investing in their ETFs, investors delegate their voting power to these funds, increasing their influence on political and economic decisions worldwide. For example, Larry Fink, CEO of BlackRock, is frequently received by heads of state due to the fund’s significance.

ETFs in the Cryptocurrency Market

In the realm of cryptocurrencies, there are ETFs such as the iShares Bitcoin Trust fund by BlackRock, launched on January 11th. This fund offers traditional market traders exposure to Bitcoin’s volatility.

Since its listing, BlackRock’s iShares Bitcoin Trust fund has accumulated nearly $20 billion in assets, establishing itself as the largest fund directly invested in Bitcoin in the world. This ETF provides direct exposure to Bitcoin, offering an additional option for investors.

Moreover, Ethereum ETFs have recently been approved, further expanding the options available for investors interested in cryptocurrencies. However, it is important to note that some ETFs, like the ProShares Bitcoin Strategy ETF (ticker: BITO), replicate the performance of cryptocurrencies through futures contracts, rather than the exact price of the underlying assets.

The approval of crypto ETFs demonstrates a growing interest from traditional finance in cryptocurrencies. Nevertheless, these launches remain limited, and the SEC is not yet ready to widely approve new ETFs for other cryptocurrencies.

Conclusion

ETFs offer an interesting opportunity for investors looking to diversify their portfolios with lower management fees. In the context of cryptocurrencies, they provide exposure to the performance of these assets without the complexities associated with direct ownership. However, it is crucial to understand the risks and implications of using ETFs, including the reliance on third parties for the management and security of the underlying assets.