The British neobank Revolut is taking a further step into the world of cryptocurrencies with the launch of its dedicated trading platform, Revolut X, initially available to customers residing in the United Kingdom.

Revolut X enters the British market

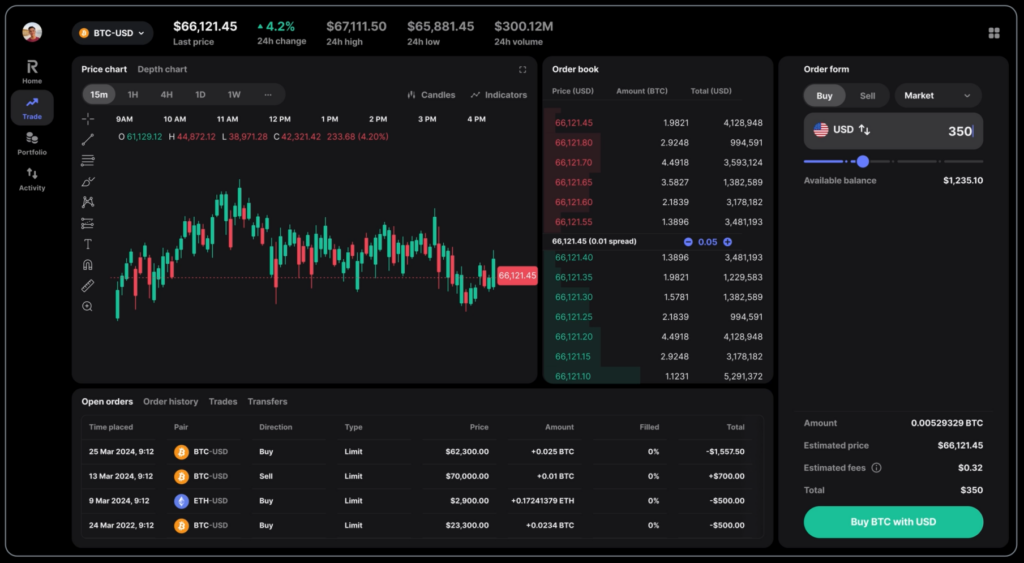

The British neobank Revolut has just announced the launch of “Revolut X,” a trading platform entirely devoted to cryptocurrencies for both individual and professional users. Revealed on May 7th, the Revolut X platform will initially be available only to fintech customers residing in the UK. Offering 0% fees for makers and 0.09% for takers regardless of trading volumes, Revolut aims to compete with the main cryptocurrency exchanges.

To start, Revolut X is expected to offer the same cryptocurrencies for trading that are already available on its app such as Bitcoin, Ether, BNB, SOL, XRP, and DOGE. However, the list is expected to expand in the coming months.

“We are excited about the introduction of our new crypto product, and we believe this leading trading platform will be a game-changer for experienced crypto traders, providing them with a safe and accessible place to trade,” says Leonid Bashlykov, Head of crypto exchange product.

According to the press release, British users of Revolut will be able to exchange cryptocurrencies or fiat currencies between Revolut and Revolut X without any fees. This initiative allows trading platform users to fund their accounts more simply, a crucial condition for a quality user experience, according to Leonid Bashlykov: “We understand that competitive fees and simplified on and off ramps are at the heart of what experienced traders expect from a cryptocurrency platform.”

Regarding the security of the cryptocurrencies, Revolut specified that they are stored in cold wallets.

The neobank continues its initiatives around cryptocurrencies

Since its launch in 2015, Revolut has been increasing its involvement in the world of cryptocurrency. Shortly before unveiling Revolut X, the neobank integrated the famous EVM wallet MetaMask under the name “Revolut Ramp,” joining the ranks of other providers such as MoonPay, Ramp, and Transak.

The fintech began offering products related to cryptocurrencies in 2017, although it has found itself needing to navigate various regulatory barriers concerning this type of asset both in the UK and the US.

However, this approach is far from bothering Revolut, according to Leonid Bashlykov: “We have always advocated for the regulation of the cryptocurrency market to ensure consumer protection and fair competition conditions”.

A Banking First in the Crypto Sector

While some banks already offer crypto trading services, Revolut stands out as one of the first to develop a platform dedicated exclusively to this purpose.

This initiative marks a significant milestone in the evolution of Revolut, which had already integrated the buying and selling of cryptocurrencies into its app for several years. The bank had informed its clients in February of its intention to launch this exchange, thus materializing its strategy to position itself as a major player in the cryptocurrency space.