As FTX’s debtors announced on Tuesday that they could repay up to “118% of the authorized claims,” there is an important nuance to interpret regarding the amounts involved. What is the status of this case?

FTX Unveils a Plan to Reimburse Creditors

In a press release published on Tuesday, FTX’s debtors announced that they had presented a reorganization plan to the bankruptcy court in order to repay the customers who were victims of the financial crime committed by Sam Bankman-Fried (SBF).

Subject to the approval of this plan, the injured parties can thus hope to obtain some form of compensation within 60 days preceding its enforcement.

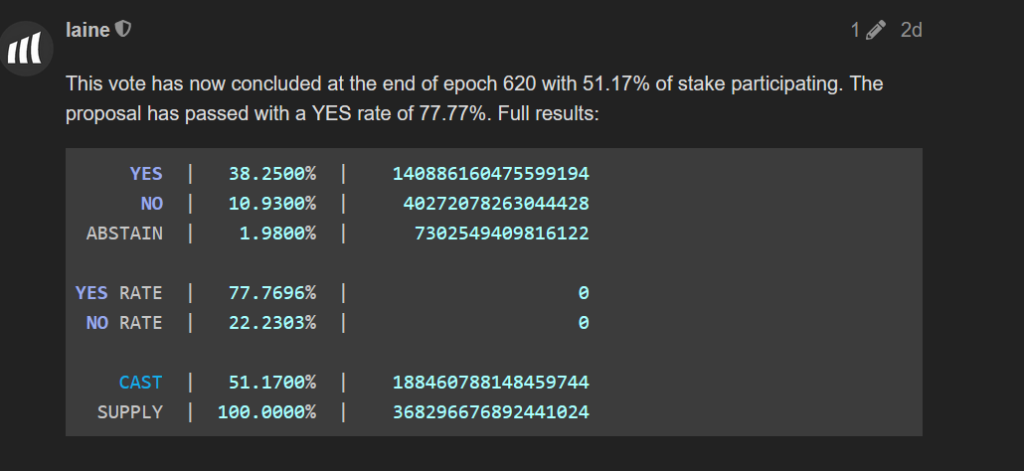

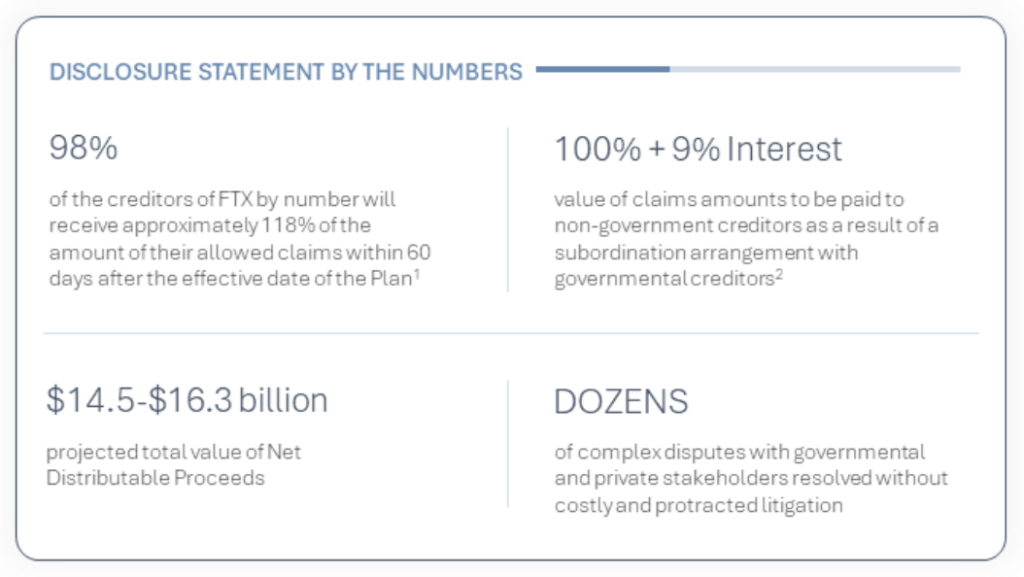

Thus, the debtors boast of being able to repay up to “118% of the authorized claims” for 98% of the creditors. John J. Ray III, the CEO appointed in charge of this restructuring, even self-congratulates on a supposed positive outcome: “We are pleased to be able to propose a Chapter 11 plan that envisions returning 100% of the bankruptcy claim amounts, plus interest for non-governmental creditors”.

In reality, it is important to recall what is defined as 100% of the claims “plus interest.” And for good reason, it was announced last month that creditors would be repaid based on the dollar value of their assets at the time of FTX’s bankruptcy in November 2022. Whereas Bitcoin (BTC) was trading around $17,000 at the time compared to more than $62,000 today, we are actually far from the mark.

On their part, the debtors try to justify themselves by explaining the complexity of the operation, given that at the time of the bankruptcy, FTX only held 0.1% of the BTC and 1.2% of the ETH it was supposed to hold for its clients.

Conclusion:

The announcement of the potentially imminent reimbursement of former FTX clients thus sounds like good news. Even if the 118% promised to creditors struggles to offset the nearly 70% of value lost on the Bitcoin price alone.