The fintech company Block, formerly known as Square, has announced its intention to issue $1.5 billion in senior notes in a private placement for qualified institutional investors.

This announcement, made on May 6, specifies that the terms of the notes, including interest rates and maturity dates, will be negotiated with initial buyers. Eligible investors to participate in this round include pension funds, banks, mutual funds, and high net-worth individuals.

Market Reaction and Use of Funds

Following this announcement, Block’s stock saw an increase of over 4%, with the share price reaching $72.40 at the time of writing. Block indicated that the raised funds could be used for the repayment of existing debt, potential acquisitions, strategic transactions, capital expenditures, investments, and working capital.

Debt Structure and Financial Outlook

According to Fitch Ratings, Block is “well-positioned to capitalize on secular growth areas in payments and consumer financial services.” Fitch also noted that since its IPO, Block has primarily used the convertible debt market to meet its external capital needs.

As of March 2024, the company had approximately $2.15 billion in outstanding convertible notes, a revolving credit facility of $775 million available until June 2028, and $2 billion in unsecured notes due in 2026 and 2031. Fitch stated: “The announced debt issuance will add additional debt to the balance sheet, which should ultimately help refinance the maturities of 2025-2026 while providing additional cash support to an already solid balance sheet.”

Block’s Commitment to Bitcoin

Jack Dorsey, co-founder of Block, recently emphasized in a letter to shareholders that Block was one of the first public companies to add Bitcoin to its balance sheet. Dorsey also revealed that the company plans to allocate 10% of its gross profit from Bitcoin-related products each month to the purchase of BTC. Between the fourth quarter of 2020 and the first quarter of 2021, Block purchased $220 million worth of Bitcoin.

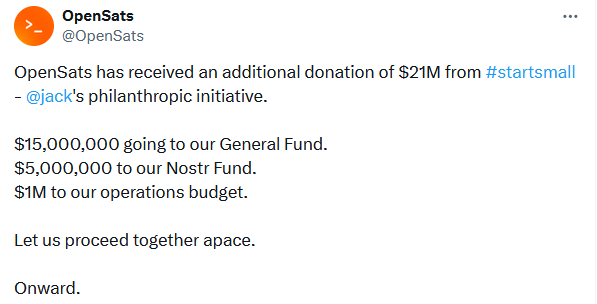

The Twitter founder also made a massive donation of $21 million to OpenSats, a platform dedicated to funding Bitcoin development.

Block’s Activities Monitored by Authorities

Block has recently become the target of an investigation by the United States Department of Justice (DOJ). This investigation was initiated following the discovery, through internal documents, that Block had processed cryptocurrency transactions from countries subject to international financial sanctions, such as Cuba, Iran, Russia, and Venezuela. According to testimonials from former employees, the majority of these transactions were not reported to the relevant authorities.

This event echoes the recent arrest of the founders of Samouraï Wallet, a non-custodial Bitcoin wallet with a mixing feature designed to enhance user privacy.

Thus, investing a portion of its funds could be perceived negatively by U.S. authorities, who seem to have initiated an offensive against non-custodial services on their territory.