Artrade is a project that addresses quite a few issues in the art market, whether it’s for digital works you’re already familiar with like NFTs, or for physical works (for example: a sculpture, a painting…).

The art market and its issues

To begin with, let’s first understand what the art market is. It’s a vast ecosystem where art pieces, whether physical or digital, are exchanged, bought, and sold. It encompasses a diverse range of artistic forms, from classical painting to contemporary multimedia installations, as well as sculpture, photography, and many other disciplines. This market is influenced by a variety of factors, such as artistic trends, cultural movements, as well as economic, social, and political conditions.

Despite its vitality and dynamism, the art market faces several significant challenges that hinder its optimal functioning. ➮ Among these challenges, lack of transparency is one of the most concerning. Information about transactions, artwork prices, and even their authenticity can often be difficult to access, creating an environment conducive to fraud and counterfeiting. This opacity can discourage potential buyers and undermine trust in the art market.

➮ Another significant challenge is the dominance of costly intermediaries. Transactions in the art market typically involve a multitude of intermediary actors such as art galleries, auction houses, and brokers. These intermediaries often take hefty commissions, which can significantly reduce artists’ profits and make artworks more expensive for buyers. This, in turn, can also limit market access for emerging artists and novice collectors.

➮ Another problem is the low liquidity of this market.

ℹ️ Information : Here are some key figures about the global art market:

According to the annual report published by Art Basel and UBS, the global art market was valued at approximately $67.8 billion for the year 2022. However, it’s worth noting that this estimate is subject to fluctuations and may vary from year to year depending on various economic and social factors.

For more information, we recommend reading the extensive Art Basel and UBS report (@ArtBasel @UBS) on the art market. It’s a comprehensive 260-page masterclass, and that’s where we got my figures from. You can find it here: UBS Artmarket report

As you can see, it’s a massive market, and a liquidity issue in this kind of market isn’t just a problem; it’s a huge problem. Unlike other assets, such as stocks or currencies, artworks can often linger on the market for long periods without finding a buyer. This low liquidity makes it challenging to quickly convert artistic assets into readily available cash. This is problematic for artists needing funds to continue their creative practice or for collectors looking to diversify their investments.

➮ Another major challenge is the difficulty in certifying the authenticity of artworks. The proliferation of counterfeiting and forgery in the art market has led to widespread mistrust regarding the authenticity of works, which can deter potential buyers and compromise the value of existing collections. This uncertainty about authenticity can also lead to costly disputes among stakeholders, further complicating transactions in the art market.

So, to sum up, the art market faces a series of rather complex problems that hinder its efficiency and long-term viability. These challenges create a complex and often opaque environment for art market participants. To address these challenges, innovative, technology-driven solutions are needed, which brings us to the discussion of Artrade and its role in transforming the modern art market.

What is Artrade ?

🔹 Artrade = marketplace

First and foremost, Artrade is a marketplace for the exchange of artworks. But more importantly, it’s a revolutionary initiative that leverages blockchain capabilities to transform the way artistic transactions are conducted. By focusing on trust, transparency, and liquidity, Artrade aims to eliminate the obstacles that have long hindered the art market (as seen previously).

🔹 Artrade and blockchain

Blockchain forms the foundation of Artrade. By harnessing this decentralized and immutable technology, Artrade ensures the security and authenticity of every artwork transaction. Unlike traditional systems that often involve multiple intermediaries, Artrade eliminates these third parties by streamlining the exchange process, thereby reducing the risks of fraud and abuse.

One of the key benefits of using blockchain is the transparency it provides. Each transaction is recorded transparently and immutably, allowing stakeholders to track the journey of every artwork exchanged on the platform. This transparency strengthens trust between buyers and sellers and promotes a more equitable and accessible artistic ecosystem for all.

➮ Artrade is deployed on the Solana blockchain due to its speed and low transaction costs.

🔹 Artrade and NFTs

Artrade integrates NFT technology to address liquidity issues in the art market. NFTs enable direct and secure transactions between art enthusiasts, collectors, and creators, creating a dynamic and fluid market where artworks can be exchanged more easily.

🔹 Insight into Artrade’s Technology

Initially, the platform will provide NFC chips for free to link physical artworks to their digital counterparts on the blockchain. However, as the platform evolves, the creation of artworks on Artrade will gradually become a paid service, generating revenue for each artwork created.

Additionally, Artrade will offer paid subscriptions tailored to art market professionals, providing them with full access to all platform features. This model ensures that all users, whether artists or gallery owners, have access to tools and features to facilitate their artistic activities.

So, Artrade is a fusion of art and blockchain. By removing traditional barriers and introducing new economic models, Artrade provides artists and enthusiasts with a transparent, secure, and liquid platform to exchange and appreciate art in all its diversity.

The REAL Protocol

🔹 The REAL Protocol

The REAL protocol (Reliable Electronic Artwork Ledger) is an innovation developed by Artrade to transform the authentication of physical artworks by leveraging technology. It aims to bridge the gap between traditional art and NFTs on the blockchain by ensuring security, transparency, and authenticity in transactions.

🔹 Secure Link between Physical and Digital Art

The REAL protocol securely establishes a link between each physical artwork and its digital NFT representation using Near Field Communication (NFC) chips. This ensures the authenticity and provenance of each artwork, enhancing its value and reliability in the digital world.

ℹ️ Information : Stop! What are NFC chips? Read this 👇

➮ NFC (Near Field Communication) chips are short-range wireless communication devices that enable the exchange of information between nearby devices. They operate by emitting radio signals at a frequency of 13.56 MHz, facilitating various applications such as mobile payments, data transfer, and access control.

➮ NFC chips are widely used for:

• Contactless mobile payments, allowing users to make purchases by simply bringing their smartphone or credit card close to the payment terminal.

• Quick sharing of data between compatible devices, enabling the transfer of files, photos, videos, etc.

• Secure access control in buildings and restricted areas via identity cards or badges.

➮ NFC chips provide ease of use, security, and versatility. However, their limited range (less than 10 cm) can be a limitation for applications requiring long-distance connections.

➮ Integration into the REAL Protocol: In the context of Artrade, NFC chips are used to securely link physical artworks to their digital representations in the form of NFTs. This technology ensures the authenticity and provenance of the artworks, thereby enhancing trust among the parties involved in transactions on the platform.

🔹 Transparent Ownership Traceability

Through this linkage, the REAL protocol also ensures transparent ownership traceability, providing users with a clear history of ownership and origin of an artwork. This helps prevent counterfeiting and fraud while enhancing the trust of buyers and sellers.

🔹 Transparent and Secure Transaction Process

When purchasing an artwork, funds and the NFT ownership title are placed in an escrow smart contract, ensuring a transparent and secure transaction process. Once the buyer verifies the artwork via a scan with their smartphone, the funds and associated NFT are unlocked, enabling fair, compliant, and secure transactions.

🔹 Decentralization and Trust

The integration of the REAL protocol increases decentralized trust within the Artrade ecosystem, revolutionizing artistic authentication by allowing the coexistence of physical art and its digital representation (NFT). This strengthens their integrity, accessibility, and value in the online art market.

🔹 Openness and Future Progress

The REAL protocol will be open-source, benefiting the entire Solana community. Furthermore, it will set a new standard for the exchange of physical artworks on the blockchain. With the planned release in two versions, the REAL protocol promises a revolution in the art world, offering a level of security, transparency, and authenticity in the trading of artworks on the blockchain.

Through the REAL Protocol, Artrade aims to push the boundaries of artistic authentication, paving the way for an environment where physical and digital art coexist in total security and transparency.

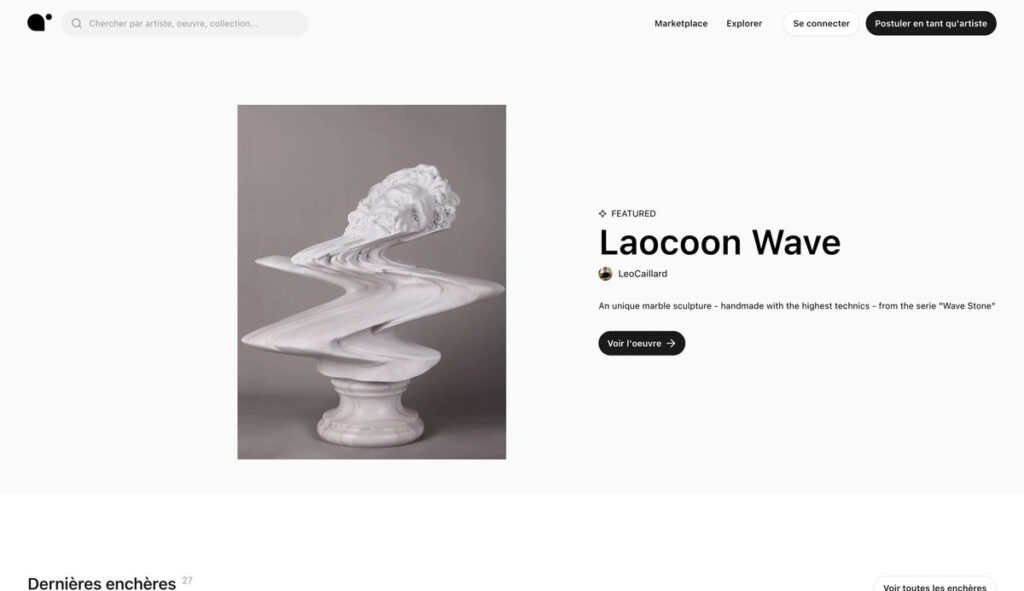

Artrade’s Platform

Now, let’s talk about Artrade’s platform, which is the flagship product. You’ll see, it’s a marketplace different from the ones you already know, with unique features and a very clean style.

🔹 Profile

When you first arrive on the platform, the initial step is to create a profile. we particularly appreciate Artrade’s approach, which offers a more personal and detailed experience compared to other platforms. In addition to providing information such as username, bio, and profile picture, the artist can also fill in fields such as artist name and highlighting their artworks. This approach highlights the artistic aspect of members rather than aspects related to web3, finance, etc…

🔹 Selling Features

A. Features for listing an artwork

When listing an artwork for sale, the artist will have the option to share multiple pieces of information. To list an artwork for sale, you will start by creating a collection in which this artwork will be listed. Then, you will enter standard information such as the name and description of the NFT. Next, you will have the opportunity to provide information that provides much more detail than on typical marketplaces and is essential for selling artworks, such as the creation date of the artwork, its dimensions, as well as co-creators if any (allowing you to credit the artists with whom you collaborated to create this artwork, if applicable).

B. A major problem solved by Artrade

After filling in all the information mentioned in part A, you will then enter the type of license to which the artwork belongs and the royalties you wish to apply to this NFT (royalties are capped at a maximum of 10%). This feature is very important because, as we have seen earlier, web2 artists face many problems, including the issue of the secondary market. It is important to know that in the art market, there is a fundamental law for the survival of artists: royalties.

ℹ️ Information : Alright, if you’re wondering, “What are royalties?” don’t worry, read this: 👇

Royalties are periodic payments made by one party (the “licensee” or “payer”) to another party (the “rights holder” or “licensor”) in exchange for the ongoing use of an asset protected by intellectual property rights, such as patents, copyrights, trademarks, or neighboring rights.

➮ Definition of royalties

Royalties essentially represent a form of financial compensation paid by an entity (e.g., a company or an individual) for the use of an asset held by another party. These payments are typically periodic and are often based on a percentage of the revenue generated from the use of that asset.

➮ Types of royalties

Royalties can be applied to various types of intellectual property, including patents, copyrights, trademarks, and neighboring rights. For example, a company may pay royalties to a patent holder to use patented technology in its products, or to an artist to reproduce or distribute a work protected by copyright.

➮ Payment mechanism

The terms of royalty payments are typically defined in a license agreement between the rights holder and the licensee. This agreement specifies the conditions for the use of the protected asset, including the validity period of the license, any limitations, and the terms of royalty payment.

➮ Benefits and considerations

For the rights holder, royalties represent a regular source of income and can contribute to the valuation of their intellectual property assets. For the licensee, the use of rights-protected assets can provide access to exclusive technologies or content without having to bear the associated development or creation costs.

➮ So, how does it work in the case of art?

In the field of art, royalties are payments that artists receive when they sell their original works or when they are subsequently resold. The resale right is an example of a royalty specific to art, which ensures artists a share of the proceeds from the future sales of their works. This allows them to benefit from the increasing success of their work in the secondary art market. So basically, royalties in art are a way for artists to earn money from the sale of their works, even after they have changed hands.

Let’s go back to our problem: as you’ve understood, once the artwork is sold, without royalties, artists wouldn’t receive any more money. That’s why a law imposes a minimum of royalties to be paid to the artist after each sale of their works. The problem today is that if you’re, for example, a lesser-known artist, you may not necessarily receive royalties after each of your sales on the secondary market because the art market isn’t transparent enough at the moment, posing a real issue for artists.

That’s why Artrade’s solution is very interesting: through this project, royalties are implemented directly into smart contracts, ensuring accountability after each sale on the secondary market.

C. Payment Choice and Sales Type

On Artrade, there are three main methods for listing an artwork:

➮ The first method is fixed-price sales. Artrade stands out here from other marketplaces. On platforms like OpenSea, for instance, when listing an NFT for sale, you specify the amount of tokens you wish to receive (for example, on Ethereum: “For the sale of this NFT, we want 1 $ETH”). On Artrade, you can proceed in the same manner as on OpenSea and other platforms for Web3 artists, but you can also set a price in euros or USD, avoiding being subject to token price fluctuations. This feature primarily targets Web2 artists, making it easier to integrate more artists.

➮ Next, we have auctions: this second type of sale allows an artist to auction their artwork in the same way as in an auction house or on an online art sales site, allowing Web2 artists to become familiar with a classic auction process.

➮ Lastly, we have the unique feature specific to Artrade: the make an offer option. This time, the seller has the final say. The buyer proposes their price, and the artist decides whether or not to sell their artwork at the offered price.

🔹 Purchase Features

Before purchasing artwork, it’s essential to find it. Artrade provides collectors with numerous filters to explore and discover artworks of interest. As you know, Artrade primarily targets the art market by addressing Web2 artists and collectors. That’s why the filters on Artrade are very specific and varied, including, for example, the type of materials used (acrylic, clay, linen, cardboard…) or the type of artistic technique employed (painting, sculpture, drawing, photography…). Additionally, you have the option to search by artist or collection, allowing you to explore all works by a specific artist or from a given collection. These options enable Web2 collectors to feel oriented and conduct precise searches.

🔹 Artrade: A Community Platform

Artrade is not just a simple marketplace; it’s also a community platform that offers features similar to a conventional social network, such as the ability to like artworks you appreciate, as well as the ability to contact artists. This latter feature is very interesting as it allows for conversations with artists and adds a more human touch to the buying and selling of artworks.

The ATR Token

Alright, we think this is the part you’ve been waiting for the most; let’s analyze together Artrade’s $ATR token.

🔹 Utility of the $ATR Token

The Artrade Token is a token used within the Artrade platform. Its primary purpose is to engage the Web3 community in the success and governance of the project. 🪙

To encourage token holders’ participation, Artrade has implemented a stacking program. It allows holders to lock their ATR for a specified period, enabling them to earn an annual yield. Initially, these rewards come from a token reserve. Subsequently, platform-generated fees are used to repurchase tokens from the market, thus ensuring a sustainable rewards system.

To maintain the token’s scarcity, Artrade has also introduced a burn program, where tokens are proportionally burned alongside distributed rewards. This strengthens the token’s value by increasing its scarcity.

In addition to its utility as a reward and participation mechanism, ATR offers various benefits to holders. For example, it grants access to exclusive features on the platform, such as badges and other perks. Moreover, token holders have a role in Artrade’s DAO, allowing them to participate in the platform’s strategic decisions (we’ll get back to this later).

Finally, $ATR tokens can be used as a form of payment on the platform, enabling users to purchase artworks while enjoying cashbacks if they pay in $ATR.

🔹 Artrade’s DAO

Artrade’s DAO aims to promote the adoption of NFTs in the art market while supporting emerging artists.

The main objective of the DAO is to fund the careers of emerging artists by acquiring their works; yes, it’s really true, Artrade invests in young artists, we think it’s a beautiful gesture. For this purpose, 51% of Artrade’s total tokens are allocated to this mission. Initially managed by the Artrade team, these tokens will gradually be transferred to token holders to transform the DAO into a truly autonomous and decentralized entity.

The DAO also focuses on promoting the utility of NFTs in the art world and on encouraging progress towards the legal acceptance of digital ownership certificates. In essence, there are communication initiatives to raise awareness about the importance of blockchain and NFTs in the traditional art market. It’s evident that the platform is committed and aims to bridge the gap between traditional art and blockchain and NFTs.

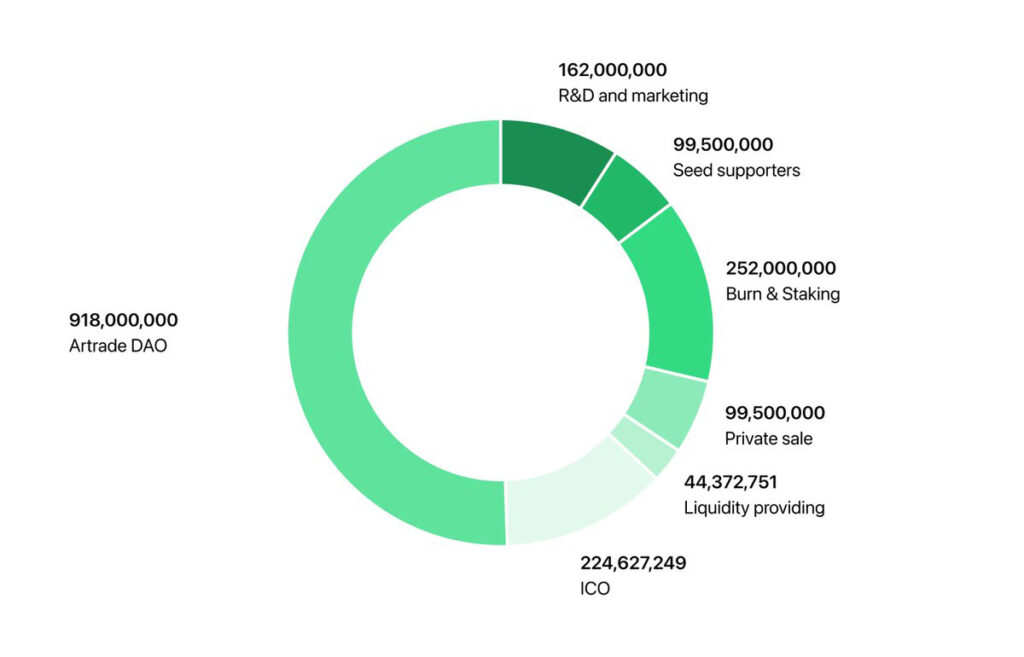

🔹 Tokenomics

➮ As usual, we will provide you with the pie chart of $ATR distribution below.

➮ $ATR is: a max supply of 1.8 billion with 14.20% of tokens in circulation at the time of writing (which is: 255,475,837 $ATR).

➮ We will provide the link to CryptoRank (which is an app providing numerous insights into tokenomics and focusing on vesting, statistics on private investors, etc…) : https://cryptorank.io/price/artrade

➮ You can also find a wealth of information about $ATR tokenomics here : Artrade Whitepaper – Tokenomics

In summary, Artrade goes far beyond a simple Marketplace. Thanks to blockchain and NFTs, it offers security and transparency in the art market. With its DAO, it promotes the adoption of NFTs. In short, Artrade reinvents art by making it accessible, transparent, and fair for everyone.