Some NFTs have reached exorbitant prices, making investment difficult or even impossible for some. Fractional NFTs could address this issue and thus democratize digital investment.

What is a Fractional NFT?

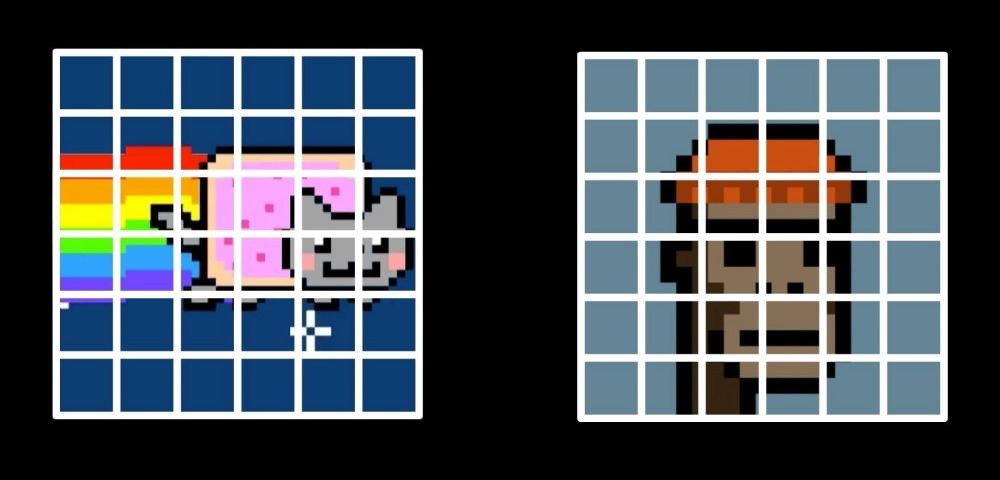

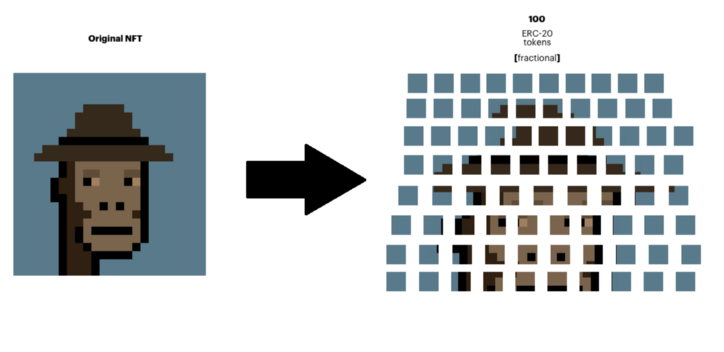

Fractional NFTs, or F-NFTs, are tokens that allow multiple investors to own a share of a unique digital asset. Unlike traditional NFTs, which are wholly owned by a single person, F-NFTs divide ownership into several parts sold individually, often in the form of ERC-20 tokens.

This mechanism is compared to buying shares in a company, where each share represents a fraction of the total ownership. “It’s a bit like if the Louvre decided to fractionate the Mona Lisa and distribute a part of it to the public. But unlike the Louvre, collective ownership of art is really only possible by using crypto art,” says Jamis Johnson, CEO of PleasrDAO.

Let’s consider an NFT representing a digital artwork sold at an initial price of 100 ETH. Through fractionation, this NFT can be divided into 1,000 parts, each part then offered at 0.1 ETH. This process is managed by a smart contract on the blockchain, ensuring transparency and security for each transaction.

The Phenomenon Is Not New

Fractional NFTs have been around since the early days, and a classic example is the infamous LORDKEK from the 2016 Rare Pepe Trading Card series. It is one of the few divisible Rare Pepe trading cards, and only ten LORDKEK cards were issued. Today, only 8 LORDKEK exist, with individuals owning 0.00042069 of a card.

Why Split an NFT?

“Fractional NFTs are most likely aimed at disrupting not only the world of fine arts and gaming but potentially even the realm of decentralized finance (DeFi) and investment as a whole,” – CoinBureau Report.

Splitting an NFT Allows Several Things:

- Introduce more liquidity into the NFT market and for a specific project.

- Democratize access to high-value NFTs by shifting ownership opportunities to individuals with smaller budgets.

- Promote community involvement, as it will no longer be considered elitist, “everyone will be in the same boat.”

- Provide liquidity to the initial NFT holder who can then reinvest this liquidity in other NFT projects.

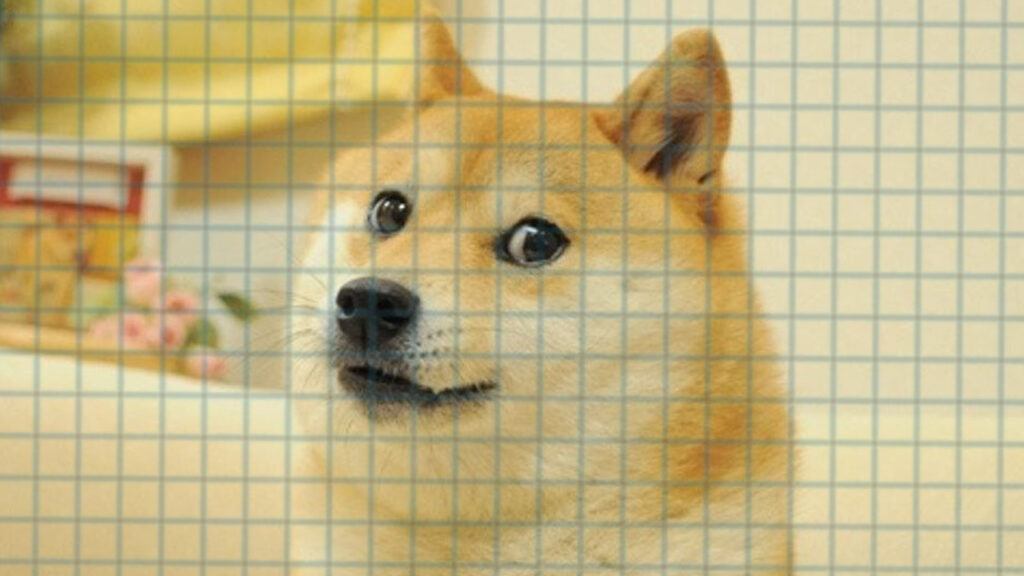

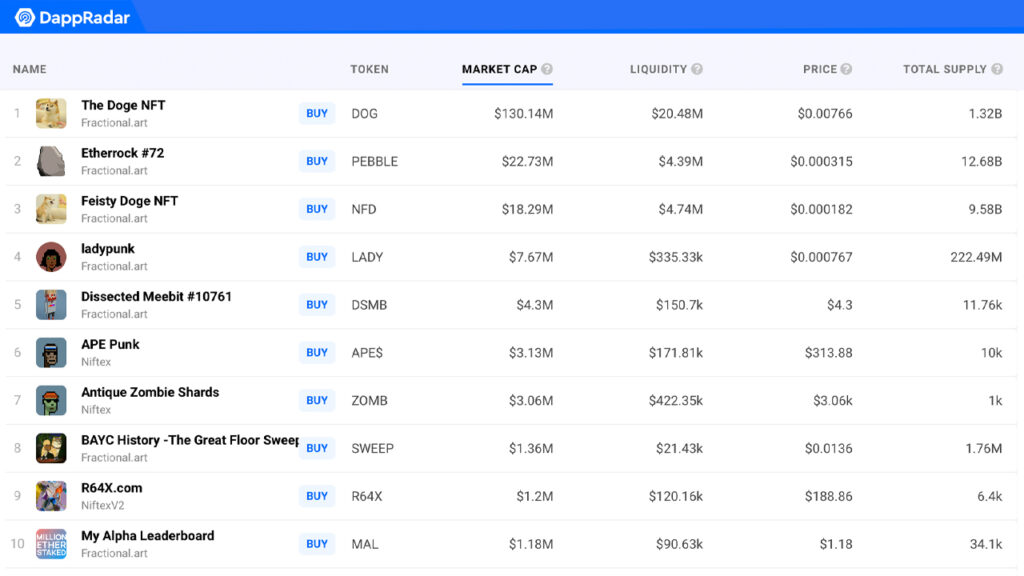

An Example of a Fractional NFT: The DOGE NFT

A concrete example is the Doge NFT, which was sold for 4 million dollars in June 2021 to PleasrDAO, and then fractionated into $DOG tokens. These tokens allow fans of the famous meme to buy shares for only 1 USD, perfectly illustrating the democratization of access to high-value digital assets.

Use Cases for Fractional NFTs

Fractional NFTs were inspired by the sale of artworks as NFTs. However, the application of the technology can have other use cases:

- F-NFTs and Gaming: With the introduction of F-NFTs, multiplayer games such as Star Atlas and Axie Infinity could use the technology to offer players the chance to group together to purchase more expensive items. In fact, Axie Infinity is already testing this with the sale of ultra-rare Axies, which are the game’s NFT assets. Here, community members have fractionalized the Axies and sold them via Niftex, a fractionalization platform.

- F-NFTs and the Metaverse: In the Metaverse sector, F-NFTs could potentially allow individuals, groups of people, and investors to come together to purchase virtual land and other assets in the virtual world.

- F-NFTs and Real Estate: The real estate sector is arguably the most suited for the fractionalization of NFTs. F-NFTs could be used to facilitate co-ownership of real estate properties. RealT and many others are concrete examples of this.

In conclusion, fractional NFTs are much more than a passing trend; they represent a significant evolution in the way digital and physical assets can be owned and traded. By offering greater accessibility, improving liquidity, and promoting inclusivity, F-NFTs redefine investment possibilities in the digital era. As the market continues to develop, it will be interesting to see how various sectors adapt and leverage the potential of fractional NFTs to create new economic and artistic opportunities.